Discover more from The Held Report

[This is the once-a-month free newsletter. To get my newsletter weekly, please join my paid subscription]

Foreward

This is my personal opinion and not reflective of my employer. Undoubtedly there will be people who disagree with my opinion. I find it in very poor taste and antithetical of crypto ethos that members of the ETH community have often tried to get me fired for expressing my opinion and will likely do so again after this.

Origin story and launch

Satoshi planted Bitcoin during the peak moment of despair in the 2008 financial crisis. With the 2008 financial crisis, trust had been lost in a world that ran on trust.

“The root problem with conventional currency is all the trust that's required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts. Their massive overhead costs make micropayments impossible.” - Satoshi Nakamoto

Satoshi set out to solve the problem of trust with money.

To ensure that the launch was considered fair, Satoshi took careful steps to make sure that the world would look back and observe that Bitcoin was launched fairly:

- No premine (he didn’t grant himself any coins)

- 2 months heads up before launching the network

- Coins had no value for 1.5 years so circulated freely (not replicable)

- Unlike every other founder in history, Satoshi never cashed out. Which is currently worth around $52B at the time this article was written.

Let’s compare Bitcoin’s launch to Ethereum:

“I happily played World of Warcraft during 2007-2010, but one day Blizzard removed the damage component from my beloved warlock's Siphon Life spell. I cried myself to sleep, and on that day I realized what horrors centralized services can bring. I soon decided to quit.” - Vitalik

Vitalik felt there had been an injustice due to the centralized nature of the video games he played. He took the initiative to build a new decentralized app platform which would allow for developers to build permissionless products.

Ethereum was perfectly crafted to match narrative market fit with Silicon Valley. Apps and app stores were all the rage at the time (when launched in 2015). Uber, Airbnb, etc were all mobile first. Ethereum was marketed as a “decentralized” app store which would allow for “dapps” to be spun up by any developer without restriction. This was the holy grail that Silicon Valley VCs and builders had dreamed about.

In the launch strategy, Ethereum decided to do something controversial at the time, a premine. Before Ethereum, most coins that had a premine were instantly labeled as untrustworthy/unfair by the crypto community. Post Ethereum, the stigma had been lifted.

Ethereum launched with 12 million ETH for the developers, and 60 million for the ICO participants to buy. Considering there are 114.8M ETH at the time of this writing, so around ~63% were premined.

Product/Market

In tech, there is a terminology called “Product Market Fit” or how well your product solves a problem for the market. In crypto, we could call this “Protocol Market Fit” or how well a protocol solves a problem for the market.

And while there is actual real world utility, part of the market fit process is crafting narratives (perception) to rally resources, value, and mindshare behind your protocol.

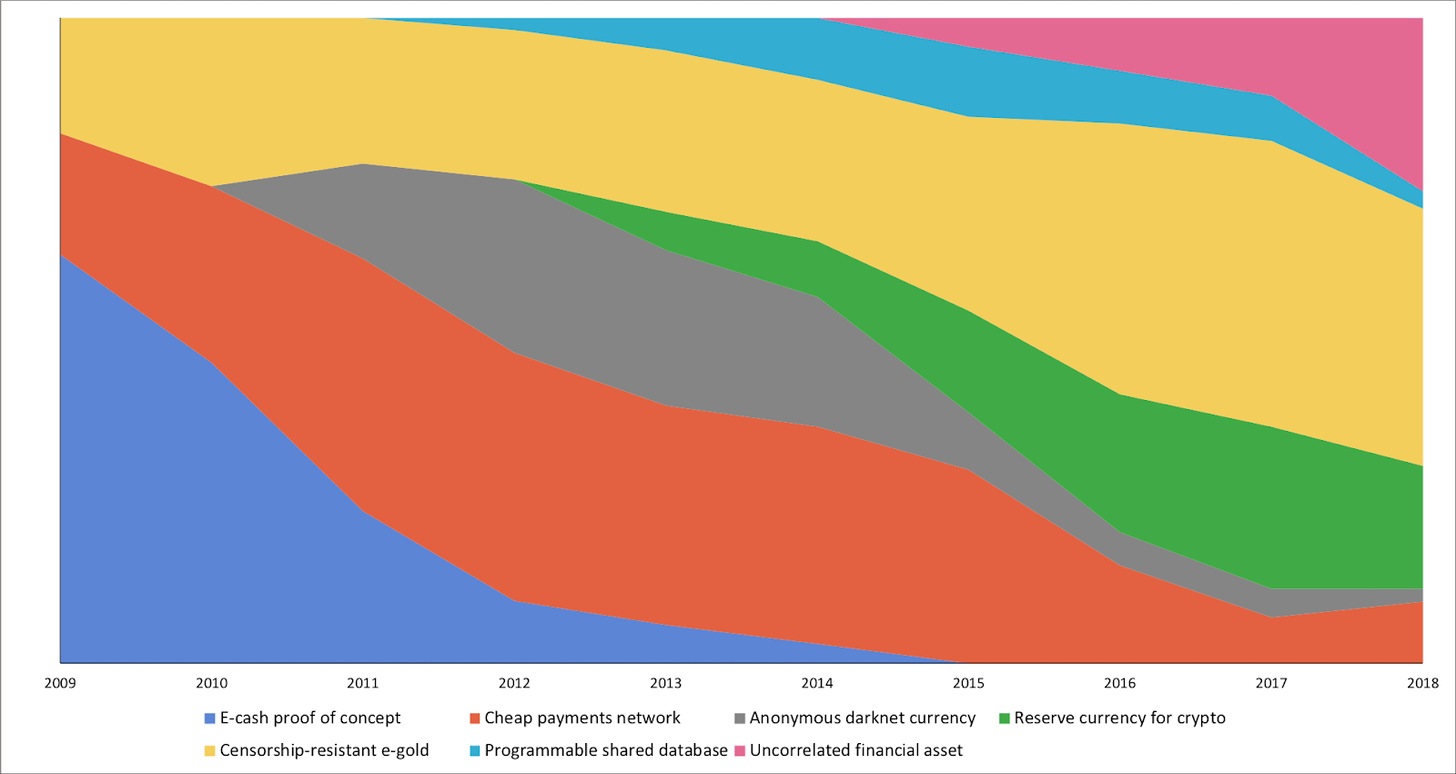

Bitcoin is not immune to the ebb and flow of narratives. Over the years, many narratives faded in and out of popularity. The chart below shows that movement over time, although it was created 2 years ago so it’s a bit outdated.

Bitcoin is distinctly different than all the other blockchains because it has had a persistent narrative since day one: Gold 2.0/SoV (Store of Value).

Bitcoin was built to solve the problem of trust with governments, to be a store of value that you could send anywhere/anytime without trusting anyone else.

Bitcoin’s narrative matches the real world utility.

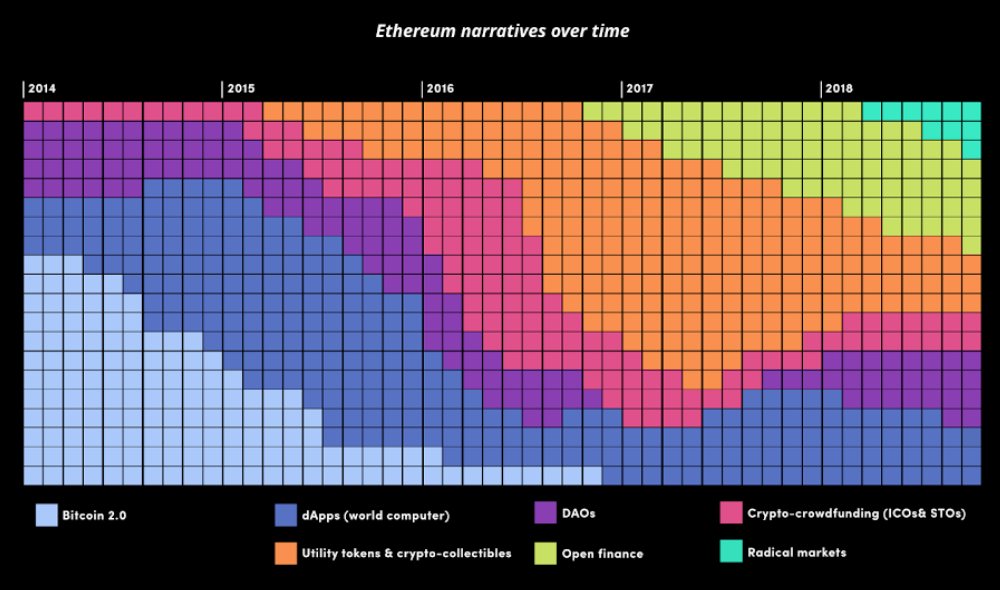

The Ethereum community has endorsed radical changes/pivots, trying to find narrative fit (aka Protocol Market Fit), even so far as to recently claim a Store of Value narrative. The Ethereum leadership team is more willing to embrace alternations to the core objective of the protocol in their search for PMF (world computer, dapps, crowdfunding, NFTs, DeFi open finance, radical markets).

The chart below demonstrates how often they shift narratives as DeFi and NFTs weren’t even included in this chart 2 years ago.

Ethereum is an aggregator of these narratives, trying each one out over the years in an attempt to seduce Bitcoin and other believers.

But there is no persistence of a singular narrative, Ethereum still trying to find PMF even after all this time.

Total Addressable Market (TAM)

Bitcoin is going after the “store of value” TAM which will capture some % of the following:

Gold ($10T)

Real Estate ($200T)

Bonds ($100T)

Equities ($30T)

Broad Money ($100T)

Fine Art/collectibles ($20T)

(Compiled by Brandon Quittem)

Ethereum is going after a smaller TAM around applications that need full decentralization, Dexs that have an upper bound TAM of exchange revenue, NFT or digitization of collectibles, etc.

When you hear people whine about “Bitcoin is boring/only doing SoV” that is such a silly statement because Bitcoin is tackling the largest TAM out there! It doesn’t need to do anything else. It’s akin to complaining that Apple is ONLY a tech company and that it should also get into oil production.

Culture of Decentralization

Bitcoin has chosen a culture of decentralization across a wide variety of aspects, whether that be around not having a single leader, to making running a full node easier to run.

The Ethereum community has chosen to embrace features of centralization such as having Vitalik remain as the leader of Ethereum (even if they claim he doesn’t influence the protocol that much, he certainly does), and increasing the difficulty of running a full node.

Decentralization is important as that is what enables Bitcoin and Ethereum to have Protocol Market Fit around permissionless system of Gold 2.0 or dapps.

This has lead to several material issues, for example:

Verifiability: Bitcoin’s monetary policy of a fixed supply is one of the greatest breakthroughs with the protocol. Due to how the Ethereum blockchain is configured, it is very hard to audit the circulating supply. Pierre Rochard, an accountant, highlighted this issue recently where it is still unresolved as to how much Ethereum actually exists.

Node Centralization: Being able to verify all transactions and supply from your home computer ensures that the rules of Bitcoin are being followed at any given moment. With Ethereum, the community has embraced accelerating costs of running nodes, which pushes developers and users to be increasingly reliant on trusted 3rd party node operates such as Infura.

In November 2020, this issue came to a head when Infura went down. This lead to many major services including exchanges not being able to connect to the Ethereum blockchain which meant no deposits or withdrawals could happen. Several months earlier Vitalik had downplayed the issue on a podcast episode:

”So I think first of all the Ethereum network is not reliant on Infura. Like if Infura died tomorrow you know the Ethereum network would keep going” - Vitalik

Which brings us to the final decentralization issue, protocol founders.

Founder: Satoshi chose to be pseudonymous, which fit the ethos of the Cypherpunks. People can project hopes and dreams on an anonymous individual, ensuring maximum neutral connection to Bitcoin. That’s why a book is often better than the movie. His pseudonymity was a critical component of the founder story — dev worship is a dangerous thing for an open source project aiming for decentralization. Volunteers need to rely on trusting the objective reality of the code, rather than focusing on the merits of the project leader.

“Satoshi left because he didn’t want its influence to affect the protocol development creating a single point of failure. The very idea of “Satoshi Vision” itself is against Satoshi’s vision for Bitcoin” — Frederico Tenga

With Ethereum, Vitalik has remained a center decider on a large swath of issues including monetary policy, game theory, etc. This leaves Ethereum open to a political attack vector as Vitalik is a human, has human flaws, and is potentially corruptible.

The base layer of the financial system should be stable

Protocol Stability

Bitcoin’s development is intentionally careful and slow. If the world’s financial system is to be replaced, it needs a stable foundation in which to build upon.

”Something to note is that it's impossible for Bitcoin to be the ‘Myspace of cryptocurrencies’ because for a currency, longevity and unchangedness are features, not bugs.” - Joe Weisenthal

What Joe is referencing is the “Lindy effect” which suggests that the longer Bitcoin remains in existence the greater society’s confidence that it will continue to exist long into the future. If Bitcoin exists for 20 years, there will be near-universal confidence that it will be available forever, much as people believe the Internet is a permanent feature of the modern world.

Ethereum however has embraced radical changes to it’s protocol in it’s short 6 year lifespan, here are a few examples:

Sharding: Ethereum wants to utilize an experimental scaling solution called “Sharding” which will help scale L1 transactions. However, there are numerous issues with how this will be implemented.

Switching from Proof of work (PoW) to Proof of Stake (PoS): Proof of stake has numerous issues including introducing subjectivity in the transaction history if there is a chain split/partitioning, liveness requirements that are hugely detrimental if you go offline, and increased financial centralization as owners of Ethereum’s premined coins will increasingly grow their position through staking vs PoW where there is churn in the validator set.

EIP 1159: A monetary policy change which is hypothesized to help the long term security model of Ethereum.“Ensures an inflationary security budget for validators, while also having a deflationary element in the form of fees.” - Lyn Alden

These constant changes leave Ethereum open to exploits and attacks. As evidenced recently by the near constant stream of DeFi thefts, and weakened decentralization.

Early in Ethereum’s lifetime, the community even embraced reversing transactions due to a hack of “The DAO.” Reversing transactions due to loss of funds violates the core principle of having a blockchain, that transactions should not be reversible.

And this reversal wasn’t due to a protocol exploit which broke social consensus (as Bitcoin has done when it was worth $0 and had an inflation bug), it was simply a theft of funds. The decision to reverse the transactions passed through ‘community consensus’ that had less than 6% of Ether in circulation voted on the matter in a process of under 2 weeks. (Source)

Monetary policy stability

Satoshi crated genius monetary policy breakthrough: a fixed supply of 21,000,000 Bitcoin.

Bitcoin has this fixed supply for several reasons: being a precise measuring stick, reducing political attack vectors, and encouraging speculative bubbles which act as a viral loop. (A more in depth article on the monetary policy is available here)

Its fixed quantity is irrelevant. What matters is just that there is a fixed amount. As economic activity moves from a primitive scale, it becomes harder for individuals to make decisions without having a fixed unit of account with which to compare value.

Regarding political attack vectors, Satoshi felt that setting a “proper” rate of inflation rate was impossible so he decided to remove human decision making from the process. Satoshi has two quotes regarding fixed supply that support this conclusion:

“Indeed there is nobody to act as central bank or federal reserve to adjust the money supply as the population of users grows. That would have required a trusted party to determine the value, because I don’t know a way for software to know the real world value of things.”

Satoshi also says

“If there was some clever way, or if we wanted to trust someone to actively manage the money supply to peg it to something, the rules could have been programmed for that.” (I think he’s being sarcastic here)

Finally, Satoshi hypothesized that a fixed supply might create speculative bubbles.

“As the number of users grows, the value per coin increases. It has the potential for a positive feedback loop; as users increase, the value goes up, which could attract more users to take advantage of the increasing value.”

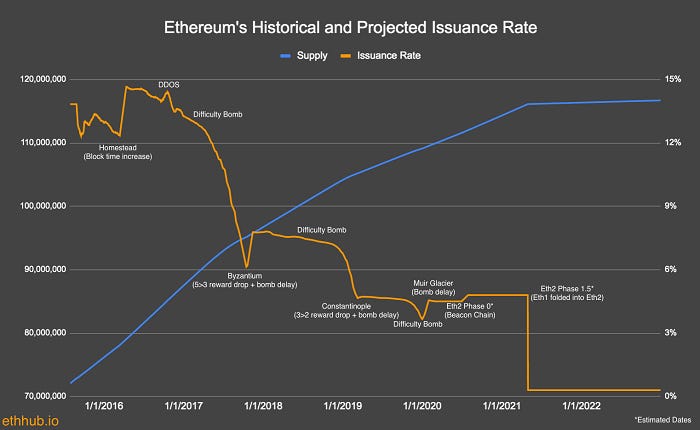

With Ethereum, they’ve embraced a constantly changing monetary policy. In effect, they’ve replaced suits (central bankers) with devs. This is no different than existing fiat money where we have to trust in a group of individuals not to change the monetary policy.

There is a fundamental misunderstanding by the Ethereum community around what constitutes “sound money.” Vitalik himself thinks that sound money = lower inflation.

”Lower inflation is sounder money!” - Vitalik

You know what other money has low inflation? The US Dollar, but no one would consider that sound money. What makes a sound money is a credible/unchanging monetary policy, and Bitcoin has the perfect iteration of that.

As Lyn Alden eloquently puts it:

”The [Ethereum] annual issuance rate with all those annotations kind of looks like it was drawn by a Bitcoiner making fun of Ethereum, but instead that’s from an Ethereum source. Various Ethereum Improvement Proposals or ‘EIPs’ by developers have changed its monetary policy over time as needed for various reasons.”

How can we trust that Ethereum’s monetary policy won’t change again? How can we be sure that it won’t be a detrimental change? Even if the Ethereum community agrees it will never change, and it honors that, it will perpetually be 12 years behind the trust that has been built with Bitcoin.

Now the retroactive explanation the Ethereum community uses to explain these changes in monetary policy are that it ensure long term security of the network will be intact. The concerns over security or monetary policy for Ethereum are very new, with discussions only being had in the last few years.

The Ethereum community continually tries to undermine confidence in Bitcoin’s monetary policy through claiming that long term Bitcoin isn’t secure because of this fixed supply. This claim is intellectually dishonest and has been debunked thoroughly.

With both the monetary policy and protocol, humans develop trust over time. There is no substitute for it. No matter what tech is build, or promises made, there is nothing that any other protocol can do to replicate the trust humans have with Bitcoin.

Conclusion

Bitcoin set out to tackle the largest TAM out there, storing value, which is a $300T+ market. Bitcoin has largely executed along that path, has gone through numerous trials and tribulations, and is looking increasingly likely to succeed.

And in order to succeed, Bitcoin just needs to stay the same. Stability with its monetary policy and protocol. Unchanging is a feature, not a bug. Some whine that it should ALSO try to do other things. But in doing so, that could potential damage it’s core objective.

If we use the analogy of a rocket ship launch, Bitcoin has already escaped earth’s atmosphere, has gone past the moon, and is on the way to Mars. There’s no reason we would want to change the trajectory or swap out the rocket engines.

With Ethereum, they’re swapping out the rockets, and changing the trajectory before they’ve left the atmosphere. It’s an incredibly risky maneuver which could yield amazing results, but at the same time could lead to it exploding mid flight.

HODL,

Dan Held

I'm no expert on crypto by any stretch, but I've never liked Ethereum nor would I ever invest in it. Deep down I believe it's a scam, or at best a wolf in sheep's clothing and a poor long term investment. I wouldn't be surprised if it skyrockets in price in the short-medium term, but I also think there's a good chance it collapses in the longer term. And if/when it does, it could take the entire crypto market down with it and shake many weaker hands out of Bitcoin in the process. But I also strongly believe that Bitcoin will prevail, regardless of what happens with Ethereum or other shitcoins. Why? Bitcoin was born in truth, represents hope, and will prevail through unity.

Such good work. Your current job at Kraken would indicate that you believe in a sort of cryptoverse of some kind (after a mass extinction event). Would you be willing to talk about some of the others in the say top 5? It’d be nice to hear thorough, sober thoughts on some of the others in contrast to so much love/hate/hype.

Love your work...