Discover more from The Held Report

Prices reflect information

“In a free market economic system, prices are knowledge, and the signals that communicate information. Prices are not simply a tool to allow capitalists to profit; they are the information system of economic production, communicating knowledge across the world and coordinating the complex processes of production.”

— Saifedean Ammous

Prices are the coordinating force of a free market system. Each individual decision-maker can rely on the prices of goods and services to help with their decision making, as the prices themselves are a distillation of all known market information into a single metric. In other words, the compression of all relevant data is ultimately manifested as price (for the more technie minded, it’s a one-way hash function).

Each individual’s buy and sell decisions, in turn, further shape prices that carry this altered information back out into the market. Some of you may have heard of this from “Efficient market hypothesis” which is about how information in the market is reflected in the price of assets like equities.

Bitcoin’s price reflects the world’s aggregate belief and trust in Bitcoin at this exact moment, manifested into that single number.

Money is the measuring stick

Money is the central information utility of the world economy. As a medium of exchange, store of value, and unit of account, money is the critical vessel of information about the conditions of markets.” — George Gilder

Capitalist economies are not equilibrium systems but dynamic domains of entrepreneurial experiments. Money should be a standard of measure for the outcomes of entrepreneurial experiments.

Companies are experiments on how to best allocate capital, and money is the standard measure for efficiency. Making money represents the efficient allocation of capital, losing money is not an efficient use of capital. And competition means decentralized planning by many separate companies and people to solve a problem in the market.

Information is Decentralized

A centrally planned economy could never match the efficiency of the open market because what is known by a single agent is only a small fraction of the sum total of knowledge held by all members of society (Hayek’s “Local Knowledge Problem”). A decentralized economy thus complements the dispersed nature of information spread throughout society. Each company is an attempt to take the local knowledge that it has and create a good or service that ultimately is the correct capital allocation (aka profit).

Central banks have an unsolvable data problem

Central banks inherently have a data problem. There’s an ingestion, processing, decision bottleneck — same as any electronic signal processing system. An economy cannot be planned by a central authority, because there is no way that a central authority can have all of the necessary knowledge to make the best decision at any single point in time, let alone all points in time.

To plan effectively, central banks would have to ingest trillions of data points daily, and ingest those data points in a perfect manner which is impossible. Every single uber taken, every single sandwich purchased, every single in-app purchase.

“We need to believe we live in a predictable, controllable world, so we turn to authoritative-sounding people who promise to satisfy that need.” — Philip Tetlock

We’ve created central banks because we want the world to make sense, and we want to feel that there is someone in charge. Even if we were able to ingest perfect data, it is hard to infer simple causality for this complex, chaotic system which involves billions of decision makers. While determining the relationship between weather and crops might seem easy, how do we determine the causality of burrito demand? Economics isn’t like the sciences, we are hamstrung by small or incomplete sample sizes. We can’t re-run the Dot com bubble with a different central bank or a different President.

Since big events come out of nowhere, forecasts may do more harm than good, giving the illusion of predictability in a world where unforeseen events control most outcomes (Aka black swan events). As Carl Richards says “Risk is what’s left over when you think you’ve thought of everything.” Daniel Kahneman also has a great take on the dangers of using history as our guide:

“Hindsight, the ability to explain the past, gives us the illusion that the world is understandable. It gives us the illusion that the world makes sense, even when it doesn’t make sense. That’s a big deal in producing mistakes in many fields.”

Here’s a useful analogy: Essentially the Fed is driving the car, which is the economy, only using the rearview mirror which is foggy, and the front windshield is opaque (you can’t see the future). How could the Fed possibly drive the car with any accuracy? What if we just let the car self adjust to the conditions of the road?

So what is our alternative?

Bitcoin’s Perfect Monetary Policy

“[Bitcoin] is the equivalent of scientific integrity: the system must not permit the manipulation of data after the experiment has taken place.” — Adam Taché

Bitcoin keeps the ruler settings fixed so results cannot be altered by a centralized planning mechanism.

And Bitcoin is the perfect iteration monetary policy. Bitcoin has a hard cap for several reasons: being a precise measuring stick, reducing political attack vectors, and encouraging speculative bubbles which act as a viral loop.

It’s precise length is irrelevant. What matters is just that there is a fixed amount. As economic activity moves from a primitive scale, it becomes harder for individuals to make decisions without having a fixed unit of account with which to compare value.

Regarding political attack vectors, Satoshi felt that setting a “proper” rate of inflation rate was impossible so he decided to remove human decision making from the process. Satoshi has two quotes regarding fixed supply that support this conclusion:

“Indeed there is nobody to act as central bank or federal reserve to adjust the money supply as the population of users grows. That would have required a trusted party to determine the value, because I don’t know a way for software to know the real world value of things.”

Satoshi also says

“If there was some clever way, or if we wanted to trust someone to actively manage the money supply to peg it to something, the rules could have been programmed for that.”

Finally, Satoshi hypothesized that a fixed supply might create speculative bubbles.

“As the number of users grows, the value per coin increases. It has the potential for a positive feedback loop; as users increase, the value goes up, which could attract more users to take advantage of the increasing value.”

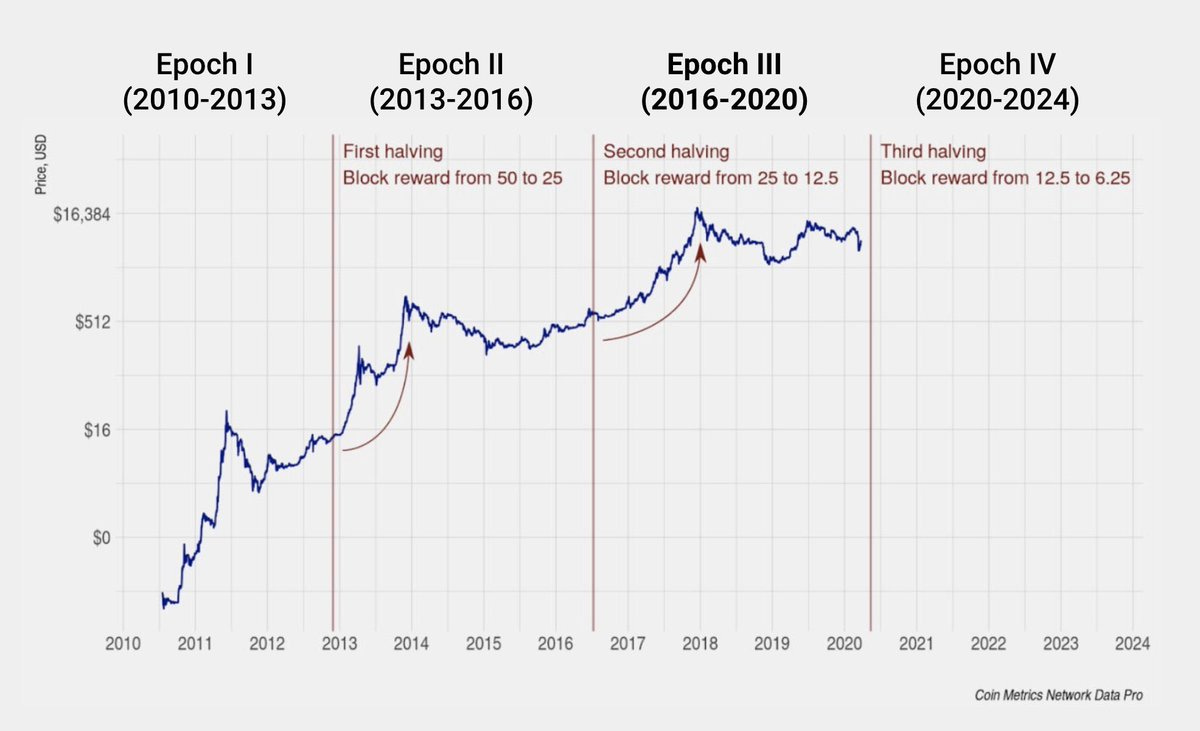

As we can see with the below chart, Bitcoin has indeed had speculative bubbles that correspond with each halving event (hardcoded into the monetary policy which is hypothesized to induce a supply shock).

Satoshi essentially built in a viral loop into the core protocol with the supply via hard cap halvings. Speculative bubbles just require one primitive trait of humans: greed. If Bitcoin's value had stayed constant we would have never heard of it.

Final thoughts

Bitcoin is stable. The protocol and monetary policy is stable. What we perceive as the instability of bitcoin's price is merely the instability or volatility of the world coming into the stability of bitcoin in ebbs and flows.

Awesome reading, thanks Dan. I like the car analogy to describe how central banks are steering the economy, but when you say ''what if we just let the car self adjust to the conditions of the road'', it immediately raised one question from me: what kind of car do we need to that? Certainly not the traditional ones. What are the attributes such car would need to possess to do that?

Dan, fantastic newsletter, thank you for your time and insights!