Discover more from The Held Report

Inflation is coming

[I listened to this song while writing]

Inflation fears are rising

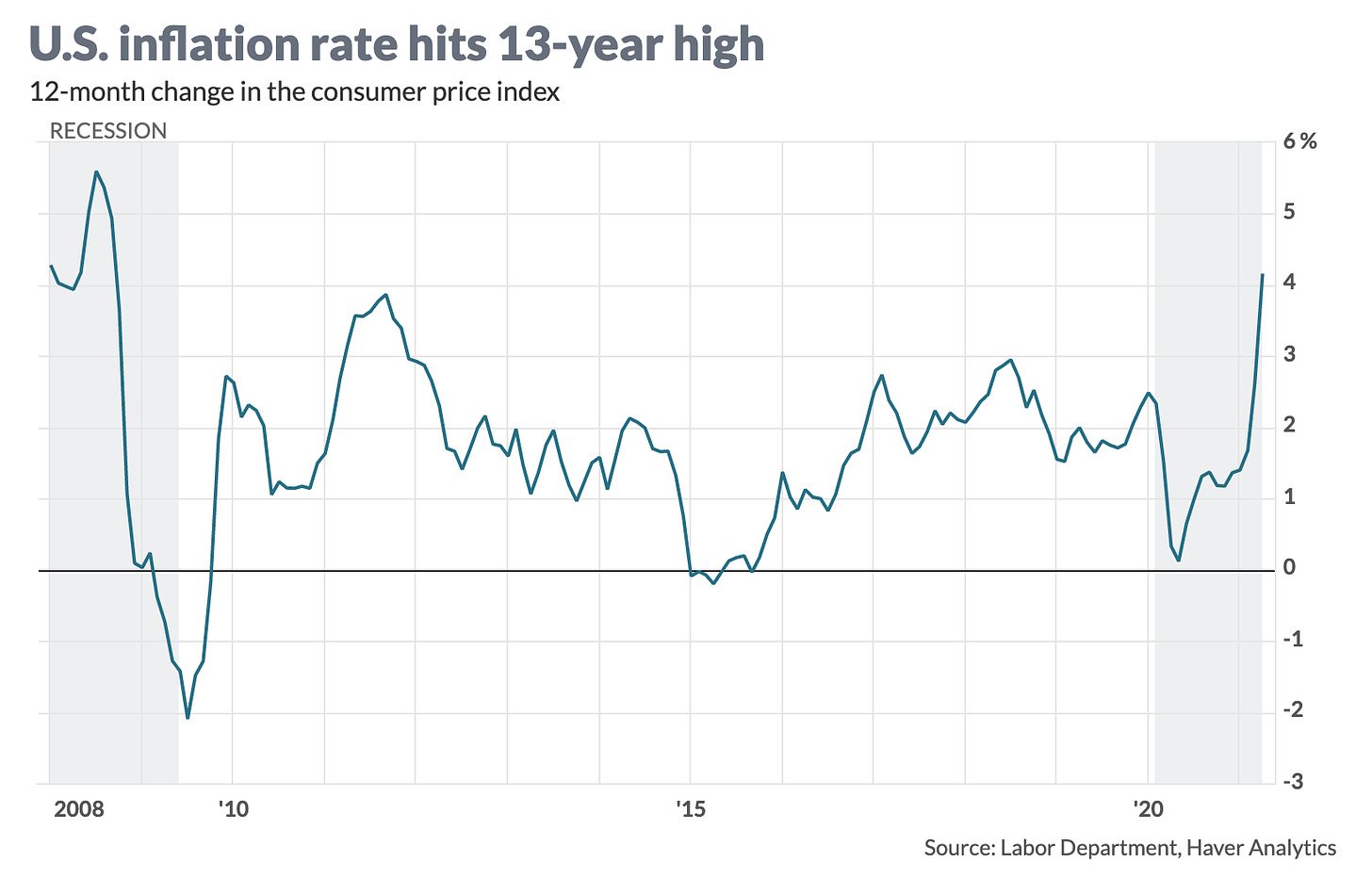

The US just hit a 13 year high inflation rate. This was unexpected by policymakers and economists. To an individual of average intelligence, it was entirely intuitive given the massive money printing (stimulus) that happened since COVID.

Economists/central banks argue that the inflation we’re seeing could be temporary, that its just an a supply shortage. However, nearly every asset has been impacted by these stimulus initiatives including: real estate, stocks, startup investing, etc.

Real Estate

Home prices nationally in January were up 11.2% year over year. That’s the largest annual gain in nearly 15 years.

“They’ve continued on autopilot. I don’t think there’s been any discussion within the Fed. The Fed is just afraid to change because they don’t want it to be seen as a form of taking their foot off the pedal”- Peter Boockvar (CIO at Bleakley Advisory Group)

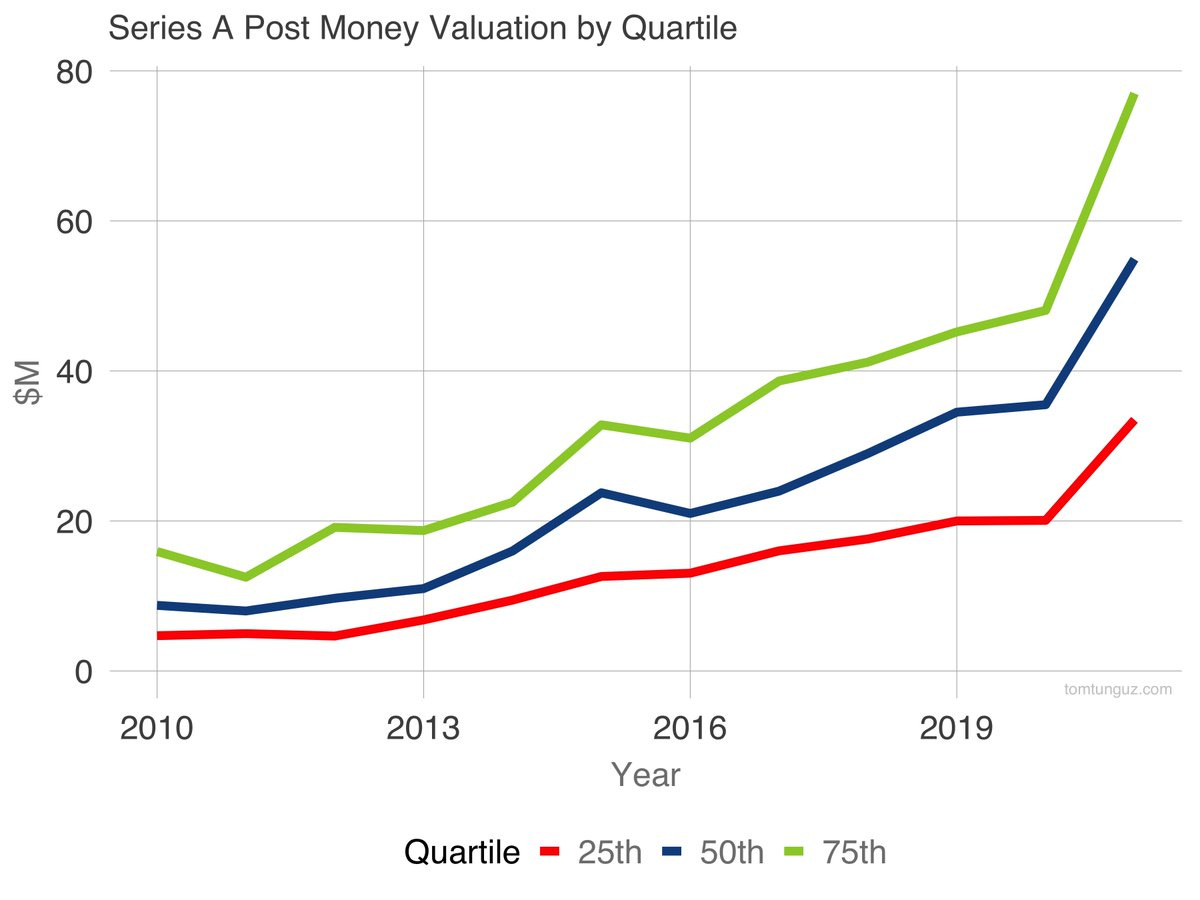

Startups

In startups, the market is smoking hot with Series A post money valuations skyrocketing.

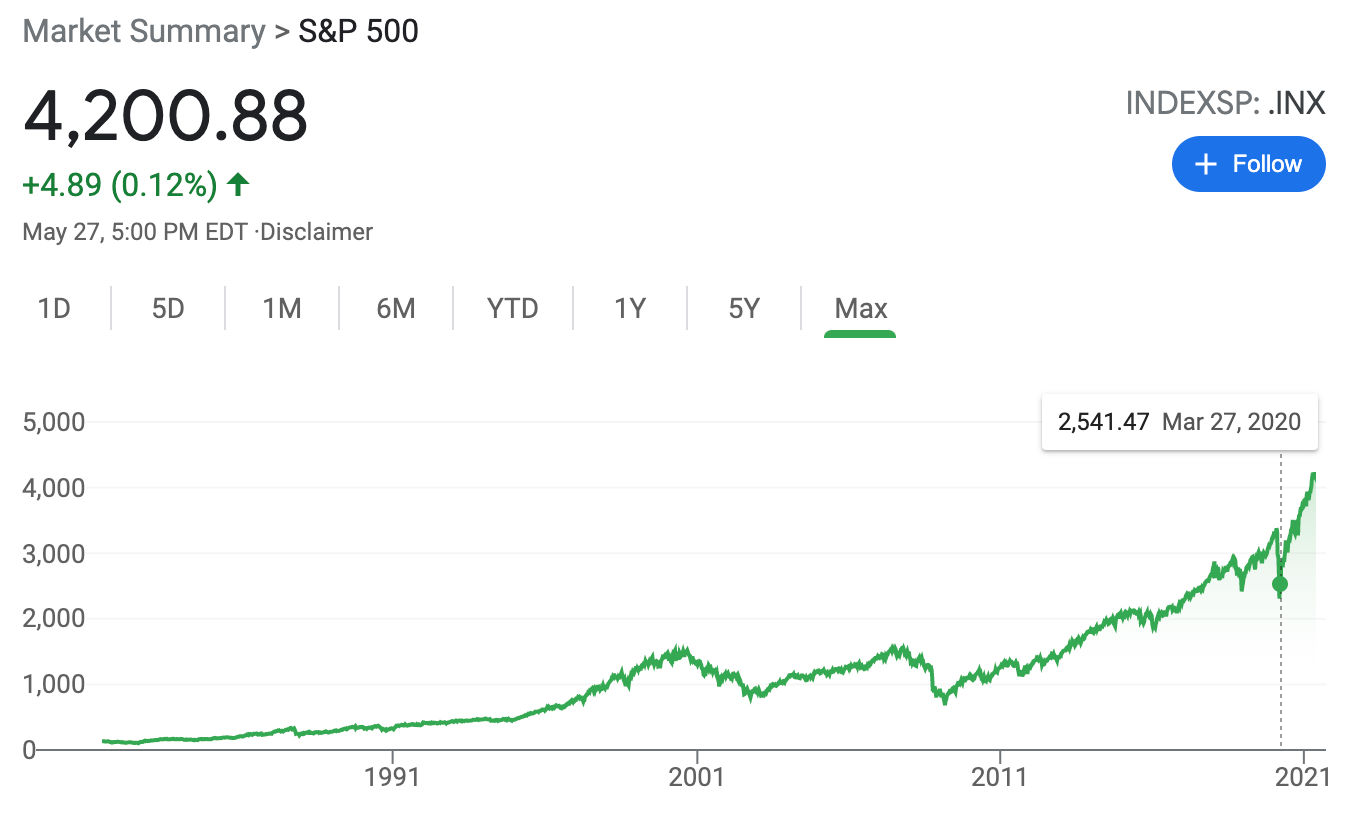

Stonks

Equities have soared. The S&P 500 is up nearly 40% post COVID! What has changed about the economy that would make these companies more valuable?

With money printer go brrr equities resemble more of a casino than investment.

Fed moves the goalpost

The Fed recently changed its language on inflation, replacing its 2% inflation target commitment with “[seeking] to achieve inflation that averages 2% over time.”

This change is a substantial departure from the previous flexible inflation targeting method. Monetary policy under inflation targeting was symmetric—the Fed would respond equally to overshooting and undershooting of the target.

Average inflation targeting means that policymakers would consider those deviations and allow inflation to modestly and temporarily run above target to make up for past shortfalls, or vice versa.

Larry Summers, Former US Treasury Secretary who was a candidate to run the Fed weighed in recently:

"We're taking very substantial risks on the inflation side……The sense of serenity and complacency being projected by the economic policymakers, that this is all something that can easily be managed, is misplaced." - Larry Summers (Former US Treasury Secretary)

The Fed doesn’t care about potential inflation worries. It is signaling that interest rates will remain super low for the near term, while currently buying $120B a month of bonds.

"The Fed's idea used to be that it removed the punchbowl before the party got good….now, the Fed's doctrine is that it will only remove the punchbowl after it sees some people staggering around drunk….We are printing money, we are creating government bonds, we are borrowing on unprecedented scales…" - Larry Summers

Fed officials have repeatedly insisted that rising inflation — consumer prices in April jumped the most since 2008 — will fade as the economy fully reopens.

However, if people expect prices to rise, coupled with supply shortages, coupled with lack of trust in fiat, then we could easily see this become a self-fulfilling prophecy as expectations of price increase climb so do prices.

Promoted: CryptoTag is the most secure storage system for your Bitcoin wallet backup. Fireproof, waterproof, crushproof, bulletproof, it’s the best way to store your Bitcoin.

Inflation is not evenly distributed

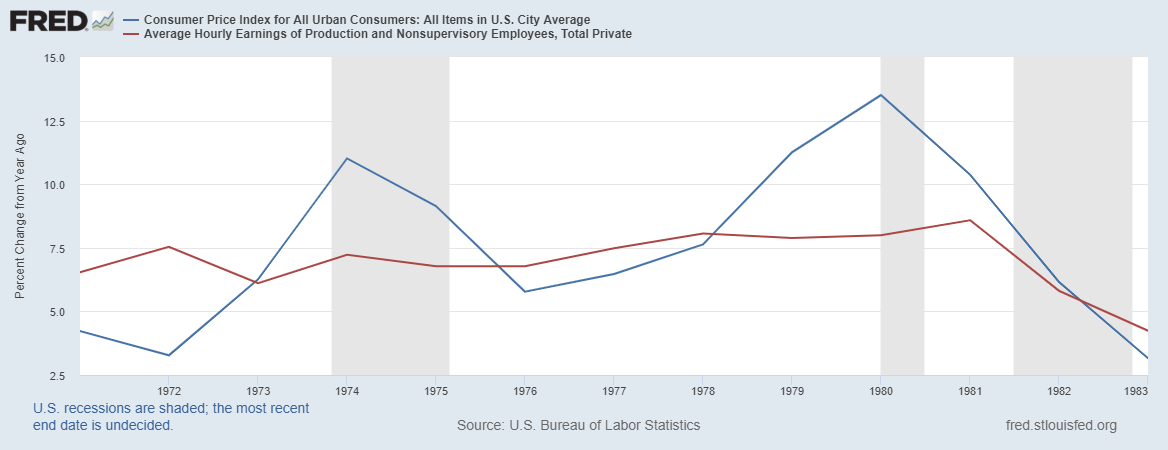

If wages kept up with inflation, then it wouldn’t be a big deal. Costs would rise, but so would your salary, which means that nothing really changes other than unit of account number.

The problem is that inflation isn’t evenly distributed. As Noah Smith recently highlighted in his newsletter.

Wages didn’t keep up with inflation, so workers got poorer. TL;DR wages are more “sticky” than prices which can be adjusted much more easily.

How inflation impacts Bitcoin

Bitcoin was launched in the 2008 financial crisis as an antidote to bad central banking policy. What policymakers did then was unprecedented in all recorded financial history.

But that pales in comparison to 2020 when policymakers completely abandoned any rational long-term thinking.

This is why Bitcoin was created, to protect against recklessness by the financial elites.

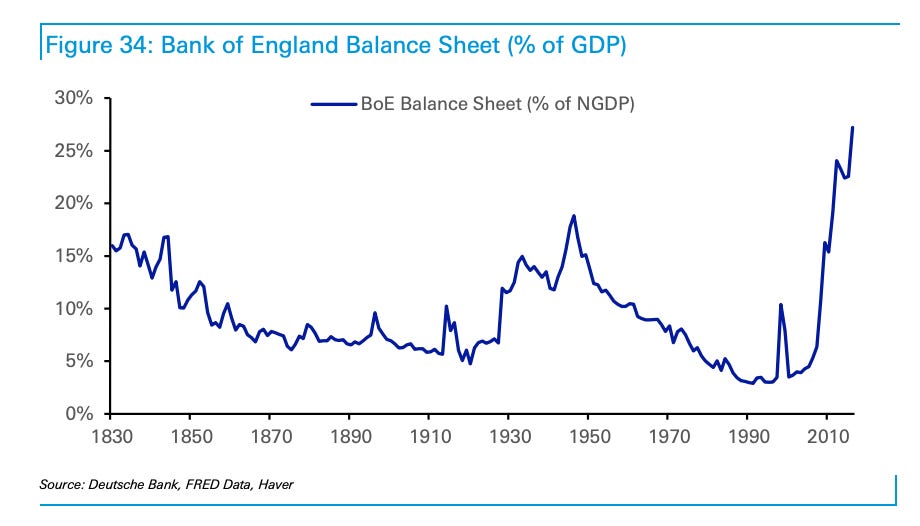

The below charts were originally compiled by DB’s Jim Reid and updated in 2017. If we were to plot up through 2020, the results would be shocking.

Never before have we had such debt and such low-yielding bonds. Risk has been massively distorted.

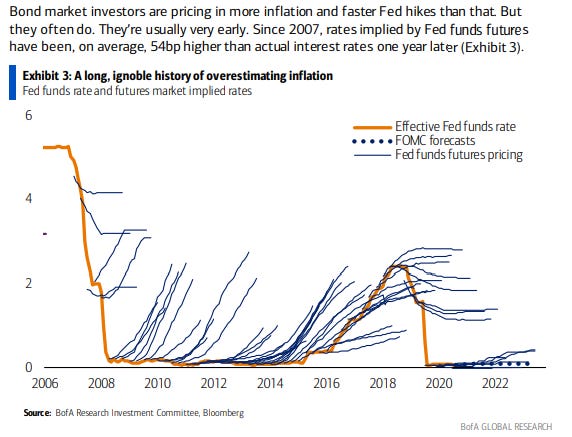

The chart below is the implied path of US interest rates based on Fed Funds pricing versus the actual path of interest rates. As you can see the “smartest” people in the world have no idea what will happen next.

This is entirely intuitive.

Central banks inherently have a data problem. There’s ingestion, processing, decision bottleneck — same as any electronic signal processing system. An economy cannot be planned by a central authority, because there is no way that a central authority can have all of the necessary knowledge to make the best decision at any single point in time, let alone all points in time.

“It is a problem of the utilization of knowledge which is not given to anyone in its totality” — Hayek

To operate effectively, central banks would have to ingest trillions of data points daily, and ingest those data points in a perfect manner which is impossible. Every single uber taken, every single sandwich purchased, every single in-app purchase.

“We need to believe we live in a predictable, controllable world, so we turn to authoritative-sounding people who promise to satisfy that need.” — Philip Tetlock

We’ve created central banks because we want the world to make sense, and we want to feel that there is someone in charge. Even if we were able to ingest perfect data, it is hard to infer simple causality for this complex, chaotic system which involves billions of decision-makers. While determining the relationship between weather and crops might seem easy, how do we determine the causality of burrito demand? Economics isn’t like the sciences, we are hamstrung by small or incomplete sample sizes. We can’t re-run the Dotcom bubble with a different central bank or a different President.

This brings us to how central banks measure impact and make decisions. There is a classic product saying that goes “If you can’t measure it you can’t manage it.” It’s hard to even measure a kilogram with extreme precision, so how could we possibly measure inflation properly? (ex: CPI excludes food and energy!)

Since big events come out of nowhere, forecasts may do more harm than good, giving the illusion of predictability in a world where unforeseen events control most outcomes (Aka black swan events). As Carl Richards says “Risk is what’s leftover when you think you’ve thought of everything.” Daniel Kahneman also has a great take on the dangers of using history as our guide:

“Hindsight, the ability to explain the past, gives us the illusion that the world is understandable. It gives us the illusion that the world makes sense, even when it doesn’t make sense. That’s a big deal in producing mistakes in many fields.”

Here’s a useful analogy: Essentially the Fed is driving the car, which is the economy, only using the rearview mirror which is foggy, and the front windshield is opaque (you can’t see the future). How could the Fed possibly drive the car with any accuracy? What if we just let the car self adjust to the conditions of the road?

History cannot be interpreted without the aid of imagination and intuition. The sheer quantity of evidence is so overwhelming that selection is inevitable.

So how does this all play out?

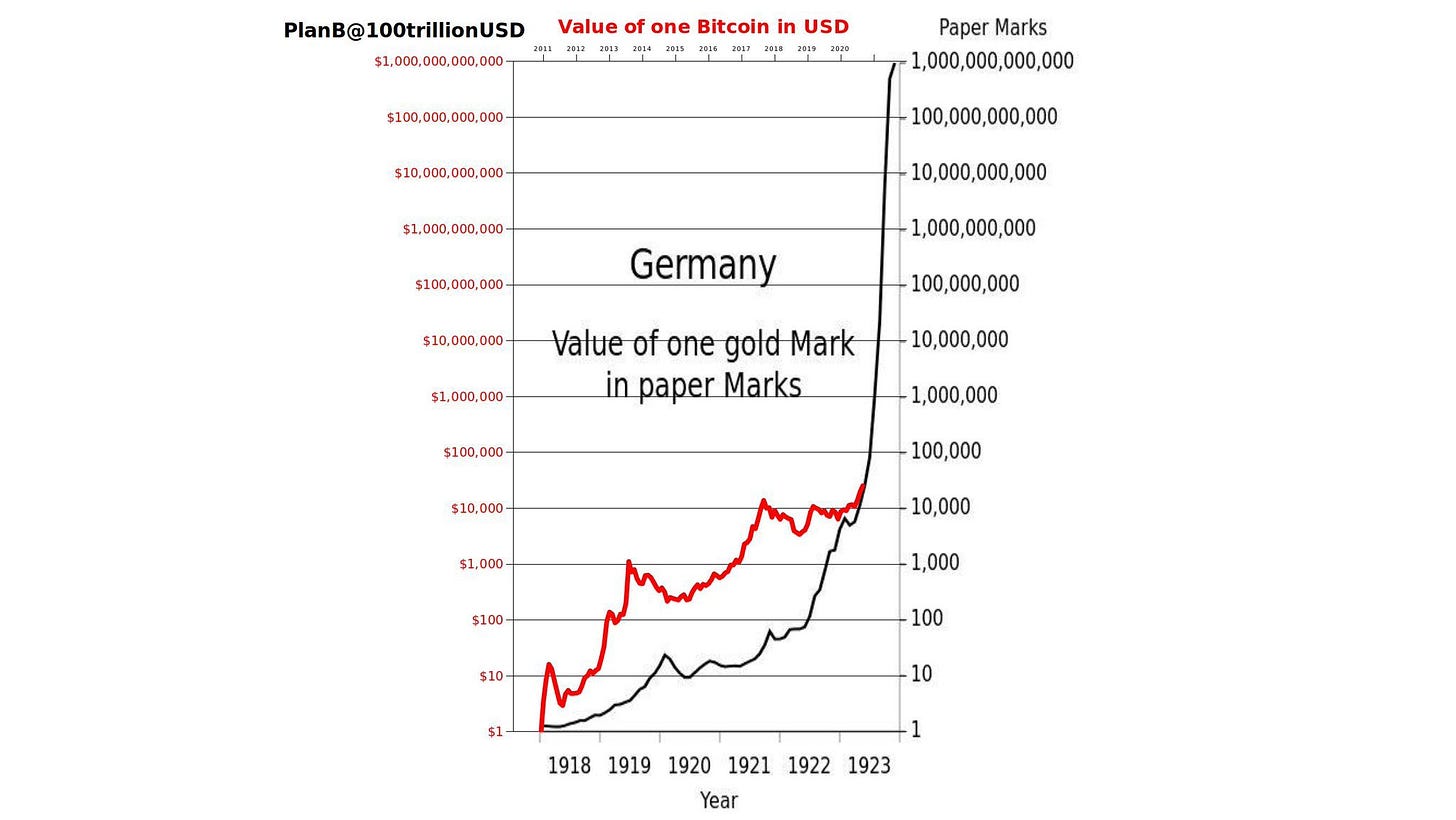

Here is the classic chart of Weimar Germany of gold priced in the German Mark going parabolic. What is new is the price of Bitcoin plotted over that. This is what the outcome of money printer go brr operations looks like, and the potential for Bitcoin’s price in USD.

Red line is Bitcoin, black line is Deustche marks

It can be hard to HODL Bitcoin along that journey, even with the tremendous upside potential.

The above chart doesn’t represent the volatility during the hyper-inflationary period. Intense drawdowns are all part of the process as represented below.

Bitcoin was made for this moment. We’re in the biggest money printing operation ever in human history, and Bitcoin is the only way out.

HODL ON,

Dan

Subscribe to The Held Report

Bitcoin DeFi explained simply. Join the over 32,000 investors and traders who read The Held Report.