Discover more from The Held Report

Whenever Bitcoin has a bull run, naysayers try to cope with missing the boat by rationalizing why it will fail through “Fear, Uncertainty, and Doubt” or what we Bitcoiners have nicknamed “FUD.” Most of these are completely unsubstantiated, but annoying persist as negative narratives Bitcoin must fight against.

I’m seeing more and more of these pop up while Bitcoin surges, so I’m going to do a rapid fire session where I knock a few of the more popular ones out:

Intrinsic Value

Complaining it has no intrinsic value when their primary government currency has absolutely no intrinsic value (No, the US dollar is not backed by gold).

“Bitcoin units have no intrinsic value… the U.S. dollar, the euro, and the Swiss franc, have no intrinsic value either.” - Federal Reserve

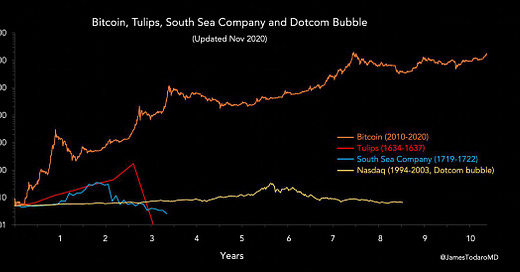

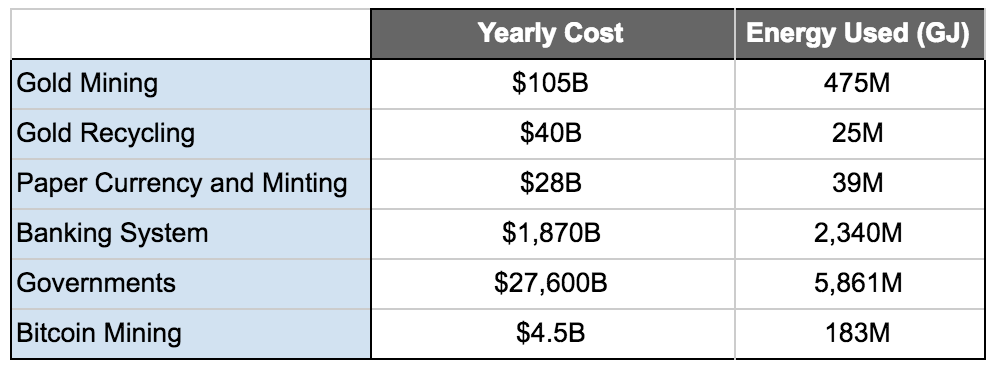

Bitcoin is a bubble

“Fads typically don’t last 12 years” - JP Morgan

Bitcoin ain’t tulips. It provides the world with the best digital store of value ever created, allowing people to store value that is hard to seize and transmit it to anyone else in the world without permission.

Bitcoin is the bubble that never pops.

Money Laundering & Drugs

Approximately $2T a year globally is laundered, Americans spend $150B on drugs annually, Crypto market cap is $1.1T as of this tweet storm. The problem rests with government money, not Bitcoin or crypto which most operate on transparent ledgers that make it hard to obfuscate funds.

“Cryptocurrency [represent a] “low risk” for money laundering and terrorist financing activities” - FATF

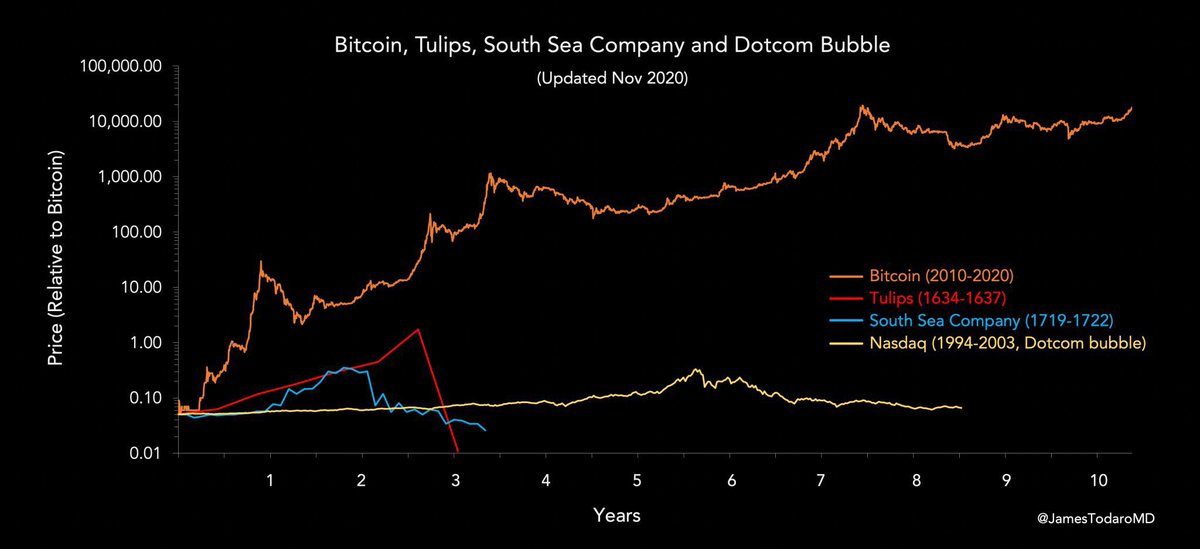

Volatility

The only constant in markets is volatility. No one says “Gold isn’t a good store of value because the price fluctuates” but we hear that all the time with Bitcoin. Below is the price of gold over the last 100 years. Look how “stable” that 4,000 year old store of value is!

What did you expect with a new emerging sound money? It certainly wasn’t going to be a linear price path.

And a stable price is antithetical to being a good store of value because that would mean the supply is centrally controlled.

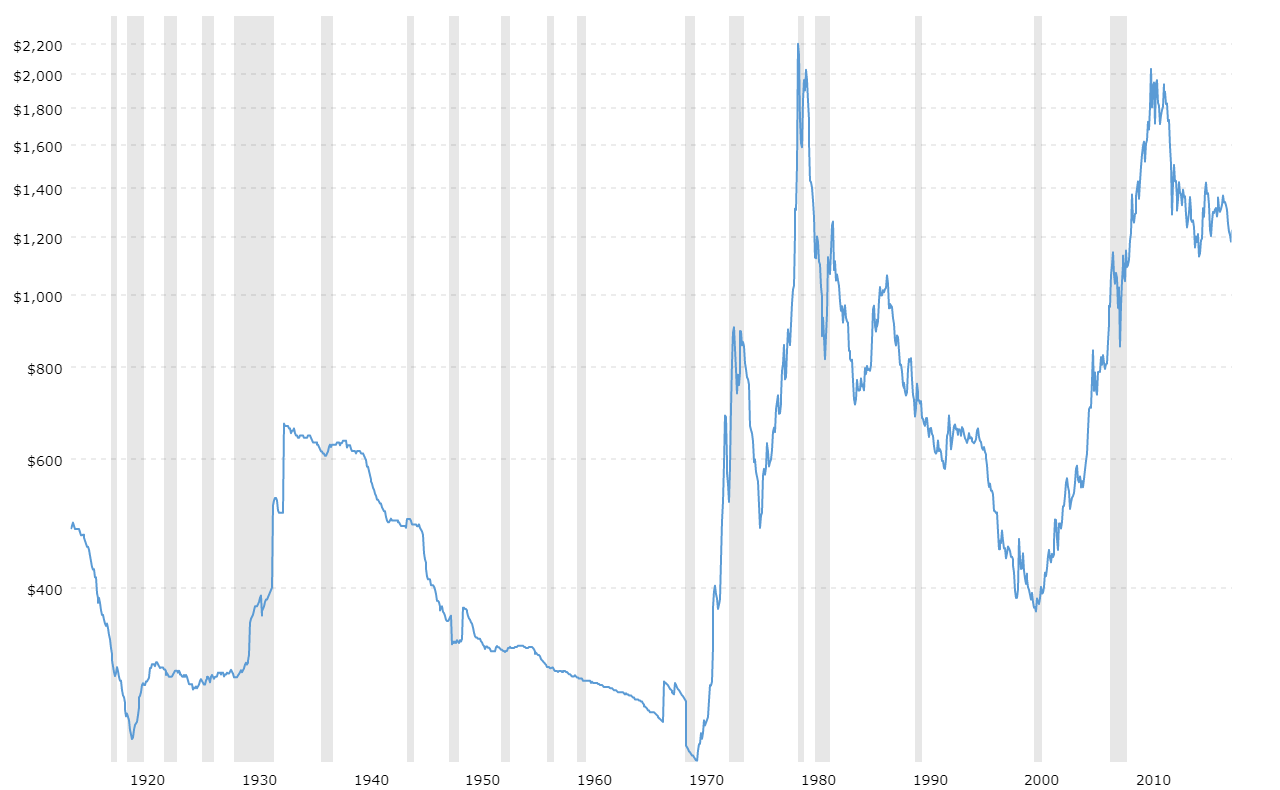

Energy Consumption

Complaining about energy consumption, without first comparing it to the energy consumption of gold mining, the financial system, government, courts, military, selfies, or watching the Kardashians.

You purchased the electricity, there is no moral “electricity police” that weigh in on your subjective usage of that energy. Here is my easy to read article on Bitcoin’s Proof of Work/energy consumption if you want to learn more.

Control

Worries that it was created by an anonymous “hacker” vs highly flawed founding individuals of their government/financial system. Worries that no one “controls” the monetary policy vs a group of old people they can’t even name. Bitcoin’s code is open source and auditable by anyone.

Bitcoin is manipulated

Over the last decade, banks globally have been fined with more than $330 billion in penalties, following investigations into manipulation of various markets/instruments: FX, metals, LIBOR, etc. Those cumulative fines = 1/3rd of total crypto market cap.

Every market has “manipulation” but that doesn’t make the price less real.

Bitcoin isn’t any worse than other markets. Bitcoin is one of most liquid assets in the world, has price discovery across dozens of venues, and has transparent order books/data feeds to everyone.

Tether

Worries that one stablecoin, which only represents 3% of Bitcoin’s market cap, could hurt Bitcoin by going bust is absurd.

Correlation isn’t causation. Just because Tether issuance went up while Bitcoin went up doesn’t mean it caused it. USDC, another popular stablecoin had the same correlation, which is entirely intuitive as folks are wiring in money to take advantage of arbitrage opportunities. Why are the FUDsters worried about USDC?

When XRP plummeted per SEC news, Bitcoin wasn’t affected. When Bitconnect was busted, Bitcoin didn’t skip a beat. Simply put, Tether is a risk for those who hold it. You are not subject to those risks if you hold Bitcoin.

Nic Carter had Dan Matuszewski, the former Circle OTC trader who himself traded billions in USD into Tether, on his podcast to dispel some of these myths.

If there was a circumstance where Tether issuance was completely fabricated (which it isn’t) that would be fantastic for Bitcoin as people would sell Tether and dump other stablecoins for Bitcoin.

Back in 2013/2014 there was the “Willybot” FUD that the price of Bitcoin had been “manipulated upwards” solely by a bot on Mt.Gox. Totally unsubstantiated but of the same flavor of FUD.

Conclusion

What all of this FUD represents is the magnitude change Bitcoin brings. Any new technology evokes FUD, which is proportional to the impact it will have on the world.

When the bicycle debuted in 1800s, it was blamed for all sorts of problems—from turning people insane to destroying women’s morals. In the future, we’ll look at these objections as we do now with bicycle objections: with laughter.

HODL,

Dan

Hi Dan, permission to translate it into Arabic? will be published on bitcoinarabic.org

Thanks Dan for being awesome and speaking the truth! Love you and all Bitcoiners.

To the moon!