Discover more from The Held Report

You can’t kill an idea.

Bitcoin extends beyond just code, it’s a mindset.

People who understand and buy into Bitcoin have already gone down the proverbial rabbit hole. They’ve had to challenge their assumptions of money, government, and social coordination.

Money represents stored time and energy of an individual. The preservation of that is a human rights issue. While they may give up freedoms over flying (FAA), driving (DMV), and many other aspects of their lives (Alphabet agency soup), the last freedom they will give up is their wealth.

“To believe that all the people in the world that have adopted bitcoin for the financial freedom and sovereignty it provides would suddenly lay down and accept the ultimate infringement of that freedom is not rational.” - Parker Lewis

Don’t Flinch

Faith is what is required to make it all work.

Fiat currency is only “backed” by the faith of those who hold it. In other words, the faith in the government that issues it. If a government were to recognize Bitcoin as a threat, the investors/citizens will wonder why that government is feeling threatened. After all, most citizens have never questioned the nature of their reality. It’s the all knowing and powerful government!

A confidence game: If you flinch, you lose.

Furthermore, trying to ban Bitcoin will increase it’s visibility. This is commonly called the “Streisand effect” which is a social phenomenon that occurs when an attempt to hide, remove, or censor information has the unintended consequence of further publicizing that information.

The enemy of your enemy is your friend

Universal shutdown is impossible due to the coordination problem of having every government in the world agree with each other’s decision. If Bitcoin is a threat to one government, it means that it is an ally to another.

A good example is global warming. If governments across the world, who have identified this as a major issue, can’t build a universal coalition, then I have little confidence they would be able to do the same for Bitcoin.

There is the possibility that governments across the world could unanimously decide to fall back to the gold standard. But that would be futile since that wouldn’t solve the underlying problem - trusting governments. I wouldn’t trust their audits, and why should you?

You can’t prohibit free choice

Both India and China have already tried to ban Bitcoin, with little success. Other non crypto examples of how prohibition doesn’t work:

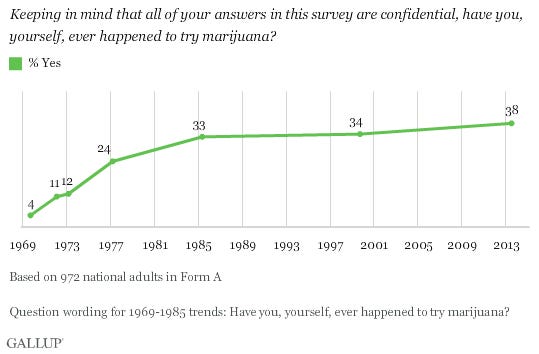

Drug wars

Over the last 40 years the US (and other countries) have waged a “war on drugs” which has little to no impact on usage, and has led to enormous social economic issues with minorities and incarceration rate.

The hypocrisy of having “legal” drugs like OxyContin (an opiate) and Adderall (amphetamine) kill 75,000+ Americans annual just adds to the absurdity. What is legal/not legal is based on the whim of alphabet soup regulator.

Free Speech

Bitcoin is code, which is a form of speech. If governments want to ban it, then there is a good chance it becomes a First Amendment (freedom of speech) issue.

There is recent precedent for controversial speech being upheld by US courts:

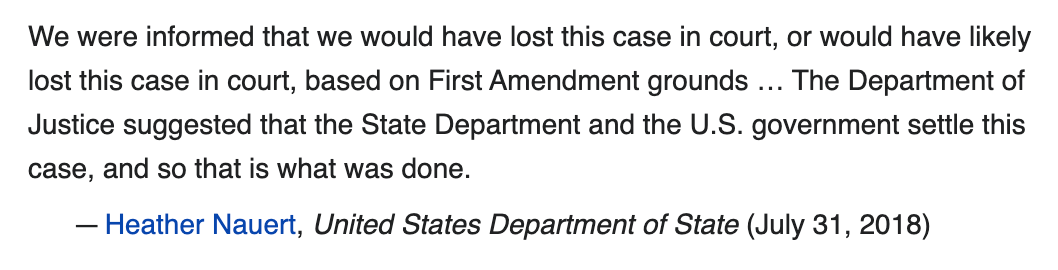

“Defense Distributed v. United States Department of State”

The case was brought to court in 2015, two years after Cody Wilson and Defense Distributed were banned from sharing files for the first 3D printed gun, Liberator, on the Internet. With a potential loss looming, the US government settled with Defense Distributed to allow them to distribute the files.

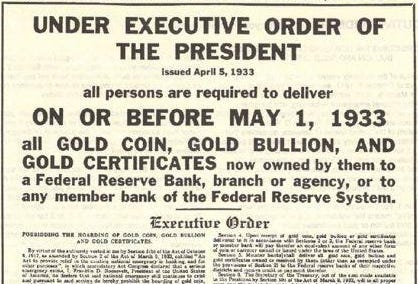

Gold

When gold was made illegal by EO 6102 in 1933 it didn’t lose its value or fade away, it actually increased in value!

And Bitcoin is distinctly different from gold in it’s portability, divisibility, and verifiability which makes it even harder to stamp out.

How Bitcoin wins

Bitcoin survives through market penetration:

1/ As Bitcoin’s price increases, the “proof of work” security of the Bitcoin network increases as well (read more about that here).

2/ If 20 - 50%+ of a countries’ population owns Bitcoin it would become very unpopular from a political perspective to ban. Bitcoin as capital is very fluid, which means these citizens can quickly move to another jurisdiction outside of that state’s control.

Checkmate

Bitcoin’s hard to understand nature, and disregard by most of the population, has been a blessing in disguise. As it rises in value and prominence it becomes more secure (via market adoption and block reward security model). At the very moment when governments recognize Bitcoin’s threat to their existence, it will be too strong, too large, and too integrated to kill.

HODL,

Dan Held

Governments can easily kill bitcoin...

https://medium.com/what-government-will-do-with-bitcoin/governments-can-and-will-attack-bitcoin-c8979c077577

Very well explained. Do not forget its properties as cash right now that makes it absolutely intractable. Puzzles me that we are in 2022 and as it was back in 2015 when I first understood it, so many peers do not get it yet.